AP, Blog, Patek Philippe, Rolex

Why Luxury Watches Are Considered an Investment

Luxury watches have long been admired for their craftsmanship and prestige, but in recent years, they’ve taken on a new role as tangible alternative assets. When people refer to a luxury watch as an “investment,” they’re not suggesting that every timepiece will appreciate in value like a hot stock. Rather, they mean that certain models from elite brands like Rolex, Patek Philippe, and Audemars Piguet function as physical assets with the potential to retain or increase their value over time, unlike most fashion accessories that depreciate immediately after purchase.

This conversation grew louder during the post-2020 watch market boom, when a perfect storm of factors converged:

- Pandemic lockdowns redirected discretionary spending toward tangible luxury goods

- Historically low interest rates made traditional savings less attractive

- Cryptocurrency millionaires sought new places to park their wealth

- Social media platforms amplified the appeal of luxury watches as status symbols among younger demographics

During the peak of this speculative cycle in early 2022, certain steel Rolex models traded at nearly three times their retail price on the secondary market.

Market Fundamentals of Luxury Watch Investment

The economic mechanics that allow certain luxury watches to function as investments are rooted in basic supply-and-demand principles, but amplified by deliberate brand strategies and cultural factors unique to haute horlogerie. Understanding these fundamentals separates informed buyers from those caught up in hype cycles.

Scarcity and Limited Production

Top-tier watch manufacturers like Rolex, Patek Philippe, and Audemars Piguet deliberately constrain production to maintain exclusivity and desirability. This isn’t accidental—it’s a core part of their century-old brand strategies. You cannot simply walk into a boutique and purchase popular steel sports models at retail price. Instead, you’ll encounter allocation systems, waiting lists that may stretch for years, and a “preferred client” culture where purchase history and spending relationships determine who gets access to the most coveted references.

Supply Control Comparison:

| Brand | Production Strategy | Secondary Market Premium |

|---|---|---|

| Rolex | Ultra-limited | 20-100%+ on popular models |

| Patek Philippe | Highly restricted | 50-200%+ on steel sports |

| Audemars Piguet | Limited allocation | 30-150%+ depending on ref |

| Omega | Moderate production | 0-30% on most models |

For example, a Rolex Daytona or Submariner purchased at retail (if you can access one) often trades immediately above its purchase price on the secondary market because demand far exceeds the controlled supply. Waiting lists for steel Patek Philippe Nautilus models once extended to a decade or more at authorized dealers, creating a secondary market where these watches commanded two to three times their retail price during peak demand periods.

Brand Heritage and Prestige

Brand reputation functions as the bedrock of value retention in luxury watches. Rolex represents reliability, global recognition, and universal status—it’s the watch that transcends cultures and generations. Patek Philippe embodies high watchmaking, craftsmanship, and old-money discretion, famously positioning its watches as heirlooms with the tagline “You never actually own a Patek Philippe. You merely look after it for the next generation”.

These brands function like blue-chip stocks in the watch world—they’ve proven their staying power over decades or even centuries, and that history creates deep-rooted demand. Contrast this with fashion brands that venture into watchmaking or small microbrands with no heritage. A TAG Heuer or Breitling will typically depreciate significantly after purchase, while most fashion brand watches and microbrands lose 50-80% of their value immediately upon leaving the store.

Global Demand From Collectors and Enthusiasts

The market for top luxury watches operates on a truly global scale, creating liquidity and price discovery mechanisms that didn’t exist even twenty years ago. Collectors, dealers, and resellers operate worldwide, connected through online platforms like Chrono24, WatchBox, and specialized forums where price transparency has dramatically improved.

This global demand structure means that certain models—particularly steel sports watches from Rolex, Patek Philippe, and Audemars Piguet—have become genuinely liquid assets. If you need to sell a Rolex Submariner or a Patek Nautilus, you can typically find buyers within days or weeks at market-driven prices, unlike rare vintage pieces or niche brands that might require months to find the right collector.

Historical Appreciation of Iconic Models

The case for luxury watches as investments rests heavily on the documented price performance of specific references over time. While not every model appreciates, certain iconic pieces have demonstrated clear patterns of value growth that outpace inflation and compete with traditional asset classes.

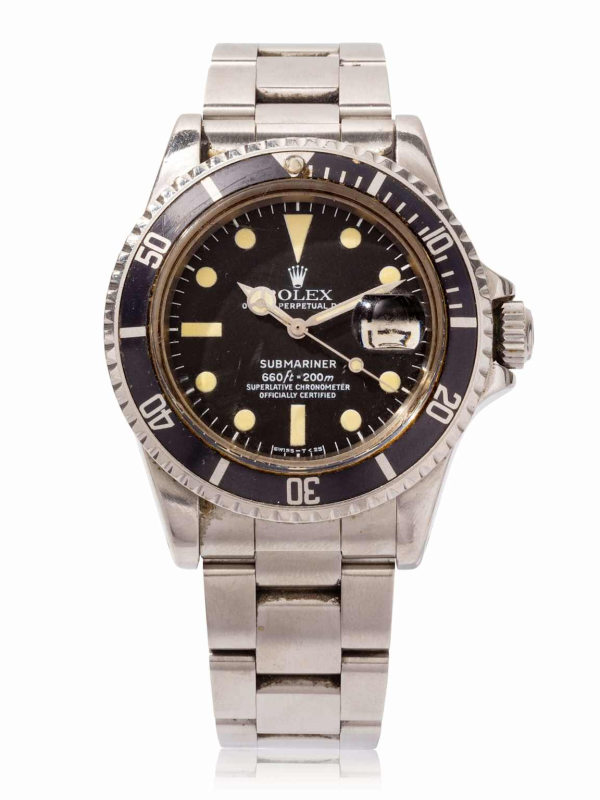

Rolex Submariner Price Growth

The Rolex Submariner stands as one of the most successful luxury watch investments in modern history. Comprehensive market data shows that the Submariner collection experienced approximately 256% appreciation from November 2010 to May 2025, with the average price climbing from around $5,000 to over $17,800.

Historical Performance:

| Period | Average Price | Change |

|---|---|---|

| 2010 | $5,000 | Baseline |

| 2015 | $7,500 | +50% |

| 2020 | $15,000 | +200% |

| 2022 | $17,800 | +256% |

| 2025 | $19,200 | +284% |

Older vintage Submariner references have performed even more dramatically. A well-preserved reference from the 1960s or 1970s that might have traded for $2,000-3,000 in the early 2000s can now command $15,000-25,000 or more depending on condition and originality. The Submariner’s success stems from its position as the archetypal tool watch—originally designed for professional divers but embraced by everyone from James Bond to business executives to casual enthusiasts.

Audemars Piguet Royal Oak Performance

Royal Oak Price Ranges (2025):

- Reference 15202 (39mm Jumbo): $75,000 – $120,000

- Reference 15500 (41mm, modern): $60,000 – $95,000

- Reference 15710 (44mm Offshore): $40,000 – $80,000

- Vintage 5402 (1970s original): $100,000 – $500,000

The Audemars Piguet Royal Oak transformed the luxury watch industry when designer Gérald Genta created the first major “luxury steel sports watch” in 1972. What seemed radical at the time—a high-end timepiece in stainless steel with an integrated bracelet and exposed screws—became one of the most influential designs in modern horology.

The Royal Oak’s investment performance has been spectacular for certain references. Standard steel models with time-and-date functions saw prices climb from $45,000-60,000 in the mid-2010s to peaks exceeding $150,000-200,000 during the height of the speculative bubble in 2021-2022. While prices corrected significantly afterward, current market values for these models still range from $45,000 to over $100,000 depending on the reference, representing substantial long-term appreciation for early buyers.

Patek Philippe Nautilus and Inflation

Nautilus Reference 5711/1A Price Evolution:

- 2016: ~$28,000 (near retail)

- 2018: ~$48,000 (+71%)

- 2019: ~$72,000 (+157%)

- 2020: ~$145,000 (+418%)

- 2021: $200,000+ (peak speculation)

- 2022: $130,000 (correction)

- 2025: $100,000-120,000 (stabilization)

The Patek Philippe Nautilus has evolved from an initially slow-selling oddity to perhaps the most mythical watch in modern collecting. Like the Royal Oak, the Nautilus was designed by Gérald Genta and represented Patek Philippe’s entry into the luxury sports watch category in 1976.

The price trajectory of the Nautilus, particularly the reference 5711/1A in steel, tells a remarkable story. From trading near its retail price of approximately $25,000-30,000 in 2016, it surged dramatically over the following years. When Patek Philippe announced the discontinuation of the 5711/1A at the end of 2020, prices exploded—temporarily surging past $200,000 in early 2021 before settling back to current levels around $100,000-130,000.

Other Nautilus references followed similar patterns. Seven different Nautilus models increased in value by at least 400% during the 2018-2022 period, demonstrating widespread appreciation across the collection rather than isolated examples.

Non-Financial Value of Luxury Watches

Even if a luxury watch doesn’t outperform the S&P 500, it can still represent a rational purchase because of the substantial non-financial value it delivers. Understanding these dimensions helps explain why sophisticated buyers willingly accept potentially lower financial returns compared to index funds or real estate.

Wearable Investment

Advantages of Wearable Assets vs. Traditional Investments:

| Factor | Luxury Watch | Stocks | Bonds |

|---|---|---|---|

| Daily enjoyment | ✓ Yes | ✗ No | ✗ No |

| Wearable/portable | ✓ Yes | ✗ No | ✗ No |

| Emotional connection | ★★★★★ | ★☆☆☆☆ | ★☆☆☆☆ |

| Tangible possession | ✓ Yes | ✗ No | ✗ No |

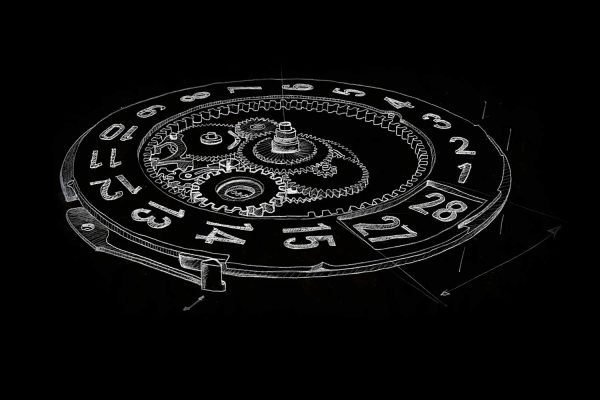

Unlike stocks, bonds, or cryptocurrency that exist only as numbers on a screen, a luxury watch is a tangible asset you can wear and enjoy every day. This concept of a “wearable investment” fundamentally changes the value equation. You derive daily utility and pleasure from the object itself—admiring the craftsmanship, appreciating the mechanical movement, and physically interacting with something beautiful and functional.

Compare this experience to owning shares in an S&P 500 index fund. While the index fund might deliver superior returns over 30 years, you cannot wear it to a business meeting, admire its intricate design over morning coffee, or feel its weight on your wrist. The watch provides experiential value throughout its entire ownership period, not just when you eventually sell it.

Emotional and Status Value

Milestones Commonly Associated with Watch Purchases:

- First professional job

- Major promotion or career achievement

- Business success or exit event

- Wedding or engagement

- 30th/40th/50th birthday milestone

Luxury watches serve as powerful markers of personal milestones and achievements. A Rolex or Omega might commemorate a first serious job, a major promotion, a successful business exit, or a significant life transition. These emotional associations give watches sentimental value that transcends their market price, creating deeply personal connections that make them irreplaceable to their owners.

The status signaling function cannot be ignored either. In business, networking, and social settings, a well-chosen watch communicates taste, success, and attention to detail without being ostentatious.

Cross-Generational Appeal

Luxury watches can function as heirlooms passed from generation to generation, carrying family stories and history across time. Unlike electronics that become obsolete or fashion items that fall out of style, a quality mechanical watch from a respected brand remains relevant and functional for decades or even centuries.

Key Factors Behind Value Growth

The specific forces that drive certain watch models to appreciate involve a complex interplay of cultural factors, media exposure, and market psychology that extends far beyond simple supply and demand.

Celebrity and Influencer Impact

Celebrity Watch Culture Drivers:

- Athletes wearing watches at sporting events

- Rap/hip-hop culture glorifying luxury watches

- Instagram influencers with watch content channels

- YouTube reviewers reaching millions of subscribers

- TikTok watch spotting trends among Gen Z

Celebrity endorsements and organic celebrity watch spotting have become major drivers of demand and value in the modern luxury watch market. When high-profile figures like athletes, actors, musicians, or business leaders are photographed wearing specific models, it can trigger significant increases in desirability and market prices.

Social media has amplified this effect exponentially. Instagram watch spotting accounts, YouTube watch reviews, and TikTok luxury content have created new pathways for watches to gain cultural momentum.

Pop Culture and Media Exposure

Iconic Watch-Media Associations:

| Watch Model | Media Appearance | Cultural Impact |

|---|---|---|

| Rolex Submariner | James Bond films | Iconic spy symbol |

| Omega Speedmaster | Apollo moon landing | Achievement symbol |

| Rolex GMT-Master | Pan Am pilots | Travel/adventure |

Watches appearing in movies, television shows, music videos, and media coverage create powerful cultural associations that drive long-term value. The Rolex Submariner’s appearance in James Bond films cemented its status as the ultimate tool watch and contributed to decades of sustained demand.

Auction Results and Record Sales

Recent Major Watch Auction Records (2024-2025):

- Rolex Daytona “Paul Newman”: $2.5-4M+

- Patek Philippe Chronograph: $3-5M+

- Rolex GMT-Master vintage: $1-2M range

Major auction houses like Christie’s, Phillips, and Sotheby’s regularly set headline-grabbing prices that influence the broader market. When a rare Patek Philippe sells for record sums at auction, it creates media coverage that raises awareness and perceived value across the entire category.

Real-World Examples of Watches That Appreciate

Rolex Daytona

Daytona Market Performance:

| Period | Price Range | Status |

|---|---|---|

| 2010-2015 | $8-12K | Moderate demand |

| 2015-2020 | $15-28K | High demand |

| 2020-2022 | $30-55K | Extreme demand |

| 2022-2024 | $25-40K | Normalization |

| 2024-2025 | $35-50K | Stabilization |

The Rolex Daytona represents perhaps the most successful modern luxury watch investment, with chronic undersupply and exceptionally high demand creating a secondary market where many references trade well above retail price.

Audemars Piguet Royal Oak

Investment Strength: ★★★★★

Price Volatility: ★★★★☆

Long-term Trend: ★★★★★

The Royal Oak has proven that simple steel sports watches with classic complications can dramatically outperform far more complicated watches from weaker brands. The instantly recognizable octagonal bezel with exposed screws and integrated bracelet created a design language so powerful that it sustained value growth across multiple decades and market cycles.

Patek Philippe Nautilus

The Patek Philippe Nautilus is frequently described as a “holy grail” in modern luxury sports watches, with certain references achieving legendary status among collectors.

When a Luxury Watch Is NOT an Investment

Brand Depreciation Comparison (Post-Purchase):

| Brand Category | Immediate Loss | 1-Year Loss | 5-Year Loss |

|---|---|---|---|

| Rolex/Patek | -5-15% | -5-20% | 10-50%+ gain |

| Omega/TAG | -15-30% | -20-35% | -10-15% |

| Fashion brands | -40-60% | -50-70% | -70-85% |

| Microbrands | -50-75% | -60-80% | -75-95% |

Fashion and Non-Iconic Brands

The harsh reality is that most watches lose significant value immediately after purchase. Fashion brands like Michael Kors, Fossil, or Armani produce watches that retail for $200-1,000 but have essentially zero resale value. Even mid-tier brands without strong collector followings typically depreciate 40-70% once they leave the store.

A high retail price doesn’t automatically translate to investment potential—it’s the combination of recognizability, heritage, collector demand, and production control that creates value retention.

Overpaying During Market Bubbles

Bubble Warning Signs:

- ❌ Waiting lists growing faster than ever before

- ❌ Secondary market premiums exceed 50-100%+ retail

- ❌ News media covering watches as investment

- ❌ Non-watch enthusiasts buying purely for flip potential

- ❌ Celebrity/influencer content surge accelerating

Buying a watch at the absolute peak of speculative hype can lock you into losses that take years or decades to recover, if they recover at all. The 2020-2022 luxury watch bubble provides a cautionary tale: buyers who purchased popular models like the Rolex Daytona, Submariner, or Patek Nautilus at peak prices in early 2022 watched those values decline 20-40% over the subsequent 12-18 months.

Buying for the Wrong Reasons

Red Flag Purchase Motivations:

- ❌ “Everyone says watches are a great investment”

- ❌ Taking on debt to buy a watch

- ❌ Depleting emergency savings for a watch

- ❌ Sacrificing important financial goals

- ❌ Buying purely for status signals

- ❌ FOMO-driven purchasing at peak prices

Perhaps the most dangerous mistake is purchasing a luxury watch you cannot comfortably afford because “everyone says watches are great investments”. If you’re taking on debt, depleting emergency savings, or sacrificing other financial goals to buy a watch, it’s not an investment—it’s a financial risk that happens to be wrapped in luxury packaging.

Real investments are part of a diversified portfolio that includes core holdings in index funds, retirement accounts, real estate, and your own earning capacity through career development or business ownership.

Conclusion: Are Luxury Watches a Good Investment for You?

What We Know About Luxury Watch Investment:

- ✓ Certain watches from top brands DO act as alternative assets

- ✓ Combination of scarcity + heritage + demand creates value

- ✓ Non-financial value (enjoyment, status, heirloom) is substantial

- ✓ 10-20 year holding periods show positive returns for top brands

Important Limitations:

- ✗ Should NOT replace core investment portfolio

- ✗ Underperform stocks/equities on average

- ✗ Lower liquidity than traditional investments

- ✗ Subject to market cycles and corrections

The Sweet Spot Strategy

The winning formula for luxury watch investing:

- Buy a watch you genuinely love

- Choose from proven investment brands (Rolex, Patek, AP)

- Purchase at reasonable pricing (retail or fair secondary)

- Plan to hold for 10+ years

- Wear and enjoy it regularly

- If it appreciates, bonus—but not the goal

Buy a watch you genuinely love, from the right brand, at the right price, and plan to hold and enjoy it for many years. If it holds its value or appreciates over time, that’s an additional bonus on top of the pleasure of ownership.

Certain watches from top brands do function as alternative assets with potential for value retention and appreciation. The combination of intentional production scarcity, decades of accumulated brand heritage, global demand from collectors, and powerful cultural amplification creates genuine investment characteristics for specific references from Rolex, Patek Philippe, and Audemars Piguet.

The answer to “are luxury watches a good investment?” is nuanced: they can be a valuable part of a diversified portfolio for those who appreciate them, but they should never replace core investments in stocks, bonds, real estate, and retirement accounts.