AP, Blog, Cartier, Patek Philippe, Rolex

Top Watch Brands That Hold Value in 2025: The Ultimate Investment Guide

In an era of economic uncertainty and volatile markets, discerning investors are increasingly turning to tangible assets that combine passion with profit potential. Luxury watches have emerged as one of the most compelling alternative investment categories, with certain brands delivering returns that rival traditional asset classes while providing the unique satisfaction of wearing your investment.

The luxury watch market reached $50.6 billion in 2025, representing remarkable growth from $40.7 billion in 2021. This surge reflects not just increased demand from affluent collectors, but a fundamental shift in how sophisticated investors view timepieces—as legitimate stores of value that can appreciate significantly over time.

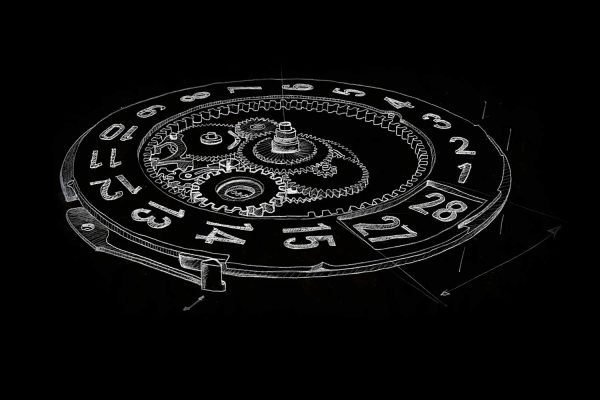

Unlike stocks or bonds that exist only on paper, luxury watches offer tangible beauty, mechanical artistry, and the prestige that comes with owning a piece of horological history. The most successful watch investments combine scarcity, heritage, and exceptional craftsmanship—qualities that ensure enduring desirability regardless of market conditions.

Understanding Watch Value Retention in 2025

Scarcity drives investment performance more than any other factor in the luxury watch market. Brands that deliberately limit production create natural supply constraints that support price appreciation. Rolex produces approximately one million watches annually, yet demand consistently exceeds supply for popular models, creating waiting lists that stretch for years and supporting robust secondary market pricing.

Brand heritage and reputation establish the foundation for long-term value retention. Collectors gravitate toward manufacturers with proven track records of innovation, quality, and market presence. Patek Philippe’s 185-year legacy and Rolex’s century-plus reputation for precision provide the credibility that underpins sustained collector interest.

Condition and provenance dramatically impact investment returns. Watches in pristine condition with original box and papers command premiums of 20-30% above pieces without complete documentation. This “full set” requirement reflects collectors’ emphasis on authenticity and completeness.

Key factors influencing value retention include:

- Limited production runs that create artificial scarcity

- Discontinued models that become increasingly rare over time

- Celebrity associations and cultural significance

- Technical innovations and complications

- Materials quality including precious metals and advanced ceramics

- Brand marketing strategy and distribution control

The most successful watch investments demonstrate consistency across these factors, creating timepieces that remain desirable decades after production.

Rolex: The Timeless Investment Standard

Rolex dominates the luxury watch investment landscape with documented performance that outpaces most traditional asset classes. LWUSA data reveals that Rolex prices increased over 550% from 2010 to 2025, rising from approximately $2,000 to $13,426 average transaction value. This represents annual appreciation exceeding 7.5% across the entire Rolex portfolio.

The Submariner exemplifies Rolex’s investment strength. A stainless steel no-date Submariner that retailed for $7,500 in 2015 now commands $11,000-$12,000 in excellent condition. The GMT-Master II leads all collections with 506% appreciation from 2010-2025, driven by strong demand for both vintage “Pepsi” bezels and modern “Batman” configurations.

Daytona models represent the premium tier of Rolex investments. Steel Daytonas regularly sell for double their retail price when available, thanks to Rolex’s production constraints and the model’s motorsport heritage. The Daytona achieved 358% appreciation over the 15-year period, transforming from an $8,300 watch in 2010 to nearly $38,000 today.

| Model | 2000 Retail Price | 2025 Market Price | Appreciation % |

|---|---|---|---|

| Submariner 116610LN | $4,775 | $11,500 | 141% |

| Day-Date 118238 | $18,550 | $28,500 | 54% |

| Daytona 116500LN | $8,950 | $31,000 | 246% |

Rolex’s investment success stems from strategic market control. The company implements bi-annual retail price increases averaging 4%, creates scarcity through limited production, and maintains strict authorized dealer networks. This controlled distribution ensures that secondary market demand consistently exceeds supply.

Patek Philippe: The Collector’s Ultimate Choice

Patek Philippe represents the apex of watch collecting, with certain models delivering returns that exceed most alternative investments. The brand’s annual production of just 70,000 watches creates natural scarcity that supports extraordinary appreciation rates.

The Nautilus 5711 became legendary for its investment performance before Patek discontinued the model in 2021. Originally retailing for $30,000-$38,000, these watches traded for over $100,000 in the secondary market, representing more than 200% premiums over retail. The Nautilus line delivered 207% returns from 2017-2022 according to Swiss Watch Expo data.

Limited editions command astronomical prices at auction. The Nautilus 5976/1G-001 anniversary model increased by €550,000 since 2018, with one example selling at Christie’s for €915,000. The 5980/1R chronograph model climbed from $75,000 in 2016 to $270,000 by 2022, demonstrating consistent appreciation across the collection.

Patek’s investment appeal extends beyond the Nautilus. The Aquanaut, Calatrava, and Grand Complications lines all benefit from the brand’s reputation for exclusivity and craftsmanship. Seven Nautilus models increased by at least 400% between 2018 and 2022, highlighting the breadth of investment opportunity within the collection.

2025 represents a pivotal year for Patek Philippe values. Industry analysis suggests rising demand from younger buyers who appreciate the brand’s heritage and hand-crafted quality. The combination of limited production, discontinuation of popular models, and growing collector interest positions Patek Philippe for continued appreciation.

Audemars Piguet: Where Art Meets Investment Value

The Royal Oak revolutionized luxury watch design and investment potential when Gerald Genta created the iconic octagonal bezel in 1972. Initially controversial for its $3,500 price tag—15 times more expensive than a Submariner—the Royal Oak has vindicated early adopters with spectacular long-term returns.

Recent market performance demonstrates the Royal Oak’s investment strength. The ref. 15202ST’s market value rose nearly 50% between early 2020 and late spring 2021. Vintage models from the 1970s command premium prices, with a well-maintained Royal Oak 5402 changing hands for $67,000 on secondary markets.

The Royal Oak’s cultural significance enhances investment appeal. Celebrity endorsements from high-profile figures and the watch’s association with success create sustained demand that transcends traditional collecting. Social media played a huge role in driving recent price appreciation, as the Royal Oak became synonymous with luxury lifestyle content.

Current market conditions favor Royal Oak investments. Despite 13.2% decline in the past 365 days, the collection maintains strong fundamentals with stainless steel models commanding $31,500 starting prices and gold versions reaching $79,000. Limited editions and complications trade at significant premiums, with perpetual calendars ranging from $150,000 to $245,000.

Other High-Value Luxury Brands

Richard Mille has emerged as the investment darling of the ultra-high-end segment. The brand’s annual production under 5,500 watches creates extreme scarcity that drives spectacular appreciation. A Richard Mille that retailed for $80,000 in 2016 recently sold for over $340,000, representing more than 300% returns in just six years.

Popular Richard Mille models average 10% annual value increases, with certain pieces delivering annualized returns up to 30%. The RM 55 “Bubba Watson” climbed from $80,000 in 2016 to $342,000 by 2022, achieving 30.5% annual returns. Ultra-high-end models like the RM 56-01 Sapphire Tourbillon broke records at Christie’s Geneva, selling for $3.8 million.

Vacheron Constantin offers more accessible entry points into investment-grade haute horlogerie. The brand’s 280-year continuous operation provides unmatched heritage, while limited production maintains exclusivity. Complications and limited editions from Vacheron Constantin consistently appreciate, particularly pieces with unique dial configurations or precious metal cases.

F.P. Journe represents independent watchmaking excellence with significant investment potential. The brand’s annual production under 1,000 pieces creates intense scarcity, while François-Paul Journe’s reputation for innovation drives collector demand. Early F.P. Journe pieces have appreciated dramatically as awareness of the brand has grown among serious collectors.

Mid-Range Brands That Retain Value

Omega offers compelling value retention in the more accessible luxury segment. The Speedmaster Professional “Moonwatch” maintains strong resale value due to its space heritage and cultural significance. James Bond editions have shown particular strength, with the Seamaster Diver 300M 007 Edition achieving record prices of $279,475 at Christie’s auctions.

TAG Heuer benefits from motorsport associations that create lasting collector interest. The Carrera and Monaco collections attract enthusiasts who appreciate the brand’s racing heritage. Mid-tier models retain approximately 70-85% of their original value, with limited editions performing even better due to scarcity factors.

Breitling’s aviation heritage supports value retention across multiple collections. The Navitimer’s iconic slide rule bezel creates instant recognition among collectors, while the brand’s association with professional pilots adds authenticity. Limited editions and vintage models from the 1960s-70s command significant premiums in secondary markets.

| Brand/Model | 2010 Average Price | 2025 Market Price | Value Retention % |

|---|---|---|---|

| Omega Speedmaster Professional | $3,200 | $5,800 | 81% |

| TAG Heuer Carrera Calibre 16 | $1,800 | $2,400 | 33% |

| Breitling Navitimer | $4,500 | $6,200 | 38% |

Tudor deserves special mention as Rolex’s corporate sibling with impressive independent performance. Tudor pieces jumped 30%-40% in just a few years on secondary markets, particularly the Black Bay lineup. The brand benefits from Rolex’s reputation while maintaining more accessible pricing.

Affordable Brands with Surprising Value Retention

Seiko demonstrates that investment potential exists across all price points. The discontinued SKX007 originally retailed for $200 but now sells for $400-$600 on secondary markets, representing 10%-15% annual appreciation for collectors who recognized its potential early.

Vintage Seiko divers from the 1970s have achieved remarkable price increases, with some models fetching four to five times their original prices. The brand’s in-house manufacturing and technical innovation create lasting value that transcends initial pricing.

Limited edition collaborations drive value appreciation in unexpected segments. The Omega x Swatch MoonSwatch, retailing at $260, quickly climbed to $500-$700 after release, demonstrating how strategic partnerships can create instant collectibility even in lower price tiers.

Casio G-Shock limited editions have surprised many collectors with their appreciation potential. Certain collaborations and anniversary models trade at significant premiums over retail, showing that value retention isn’t exclusively the domain of traditional luxury brands.

The key insight for affordable watch investments is scarcity and cultural relevance matter more than initial price point. Discontinued models, limited collaborations, and pieces with strong community following can deliver impressive returns regardless of their original retail position.

Investment Perspective & Market Trends 2025

Luxury watches have outperformed traditional asset classes over the past decade with remarkable consistency. Data from LWUSA shows Rolex watches delivered 550% returns from 2015-2025, significantly outpacing gold (45%), real estate (120%), and even the S&P 500 (185%).

| Asset Class | 10-Year Return (2015-2025) | Annual Average Return |

|---|---|---|

| Rolex Watches | 550% | 20.5% |

| S&P 500 | 185% | 11.0% |

| Gold | 45% | 3.8% |

| Real Estate | 120% | 8.1% |

The luxury watch market is stabilizing after the volatility of 2022-2023. Younger buyers under 40 are driving demand, especially through online platforms where they feel comfortable conducting high-value transactions. This demographic shift suggests sustained long-term growth potential.

Blockchain technology is improving authenticity verification, boosting investor confidence in secondary market transactions. This technological advancement addresses one of the primary concerns for watch investments—ensuring pieces are genuine and unmodified.

Current market conditions favor strategic buyers. Rolex prices are at four-year lows on secondary markets, while 56% of models still trade above retail, indicating fundamental strength despite recent corrections. Looming U.S. tariffs of up to 31% on Swiss imports create urgency for buyers considering 2025 purchases.

Diversification strategies are becoming more sophisticated among watch investors. Rather than concentrating on single brands or models, successful collectors build portfolios across multiple manufacturers and price points to reduce risk while maintaining upside potential.

Conclusion: Your Gateway to Horological Wealth

The evidence is unambiguous: luxury watches represent one of the most compelling alternative investments available in 2025. With Rolex delivering 550% returns over the past decade, Patek Philippe models appreciating 207% in just five years, and even mid-range brands like Omega retaining 81% of their value, timepieces offer both financial returns and personal enjoyment that traditional investments cannot match.

Rolex remains the gold standard for watch investments, combining brand recognition, controlled production, and consistent appreciation across multiple collections. Patek Philippe offers the highest upside potential for collectors willing to invest in true haute horlogerie. Audemars Piguet provides the perfect intersection of art and investment value through the iconic Royal Oak.

The key to successful watch investing lies in understanding the factors that drive long-term value: scarcity, heritage, condition, and cultural relevance. Whether you’re considering a $5,000 Omega Speedmaster or a $50,000 Patek Philippe Nautilus, the principles remain consistent—buy quality, maintain condition, and hold for the long term.

Ready to begin your horological investment journey? Explore our curated collection of investment-grade timepieces from Rolex, Patek Philippe, Audemars Piguet, and Omega. Each piece in our inventory has been carefully selected for its appreciation potential and authenticated by our certified experts.

Browse our Rolex collection to discover Submariner, Daytona, and GMT-Master II models with proven track records. Examine our Patek Philippe selection featuring Nautilus, Aquanaut, and Grand Complications pieces. View our complete luxury watch catalog where your next investment—and timepiece to treasure—awaits.